The Tax Ombudsman’s Yanga Mputa marked the 10th anniversary of the establishment of her office with a lecture at the University of Johannesburg.

In her lecture, Mputa highlighted the importance of tax in our society and the role of her office in resolving taxpayer complaints against SARS.

“The reason why we pay tax is because as citizens of the republic, we have an obligation to do so,” Mputa said. “We each have a responsibility to contribute to the revenue that is needed to provide services for our people,” Mputa.

Mputa also spoke about the strides that her office has made in the past 10 years, including resolving complaints about delays in the payment of tax refunds, SARS’s failure to adhere to dispute resolution processes, and its response to requests.

“Since the establishment of the office in 2013, the complaints we normally receive is SARS delaying in repaying of refunds,” Mputa said. “But through the intervention of the office, the SARS has paid those refunds.”

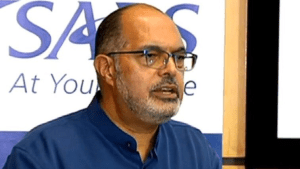

Yanga Mputa on being appointed as the Tax Ombud

Mputa also says that her office is committed to promoting and protecting taxpayer rights, while also encouraging tax compliance from South Africans.

“We want to make sure that taxpayers are aware of their rights and that they are able to access those rights. We also want to make sure that taxpayers are compliant with the tax laws,” says Mputa.

The Tax Ombudsman’s office is an independent and impartial body that was established in 2013 to resolve taxpayer complaints against SARS. The office is free to use its own procedures and does not have to follow the same rules as the courts.

If you have a complaint about SARS, you can contact the Tax Ombudsman’s office by phone, email, or post. The office’s contact details are available on its website.

The Tax Ombudsman’s office is an important resource for taxpayers who have problems with SARS. The office can help you to resolve your complaint quickly and fairly.