The South African Revenue Service (SARS) says it will come down hard on those involved in the illicit trafficing of tobacco, round tripping of containers and people submitting fictitious tax declarations.

The tax collecting body says it will also not be soft on those who submit late tax returns and will continue to submit penalties for late submissions.

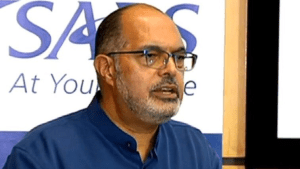

Acting SARS commissioner Mark Kingon says the submission of outstanding returns for prior years makes processing for the current year of assessment challenging.

SARS hopes to collect R1.3 trillion for the 2017-2018 tax period.

Kingon says: “I want to re- iterate this, it comes back to compliance in our country where we have tax payers who are outstanding and prepared to pay the penalty but still not submit teir tax returns. One just wonders what they are hiding in those tax returns. We will start prosecuting those people.”

“No matter what their excuse can be, to not file a return for 37 months is a shame and we need as a country to grab hold of the issue of compliance in the country.”