Finance Minister Tito Mboweni says government will not introduce any tax increases this year mainly due to a higher tax collection estimate of nearly R100 billion from the previous financial year.

Mboweni says due to the expected improvement in tax revenue collections, the government will further withdraw previously announced taxes of up to R40 billion which were announced in the previous Budget.

This year’s revenue shortfall has been revised down to R213 billion compared to R312 billion projected in last year’s Budget.

“We must advise this House that we now expect to collect R1.21 trillion in taxes during 2020/21, which is about R213 billion less than our 2020 budget expectations. This is the largest tax shortfall on record. In 2021/22 government expects to collect R1.37 trillion, provided our underlying assumptions on the performance of the economy and tax base hold.”

Mboweni is tabling the Budget in Parliament:

Tax policy changes

The corporate income tax rate will be lowered to 27 per cent for companies with years of assessment commencing on or after 1 April 2022.

The personal income tax brackets will be increased by 5 per cent, which is more than inflation. This means that if you are earning above the new tax-free threshold of R87 300, you will have at least an extra R756 in your pocket after 1 March 2021.

Mboweni says Minister for the Department of Public Service and Administration, Senzo Mchunu is working with various partners in organised labour to achieve a fair public-sector compensation dispensation when negotiating on a new multi-year wage settlement that would begin later this year.

The Minister says R83.2 billion has been made available for the public employment programmes since the 2020 Special Adjustments Budget.

This will now be augmented by R11-billion for the Presidential Youth Employment Initiative, taking the total funding for employment creation to nearly R100 billion.

“The Minister for the Department of Public Service and Administration, Minister Senzo Mchunu is working with our partners in organised labour to achieve a fair public-sector compensation dispensation when negotiations on a new multi-year wage settlement begin later this year. We have cumulatively made R83.2 billion available for the public employment programmes since the 2020 Special Adjustments Budget. We are now augmenting this by R11 billion for the Presidential Youth Employment Initiative, taking the total funding for employment creation to nearly R100 billion. This is in response to the job creation targets for young people. outlined by the President. .”

Excise duties

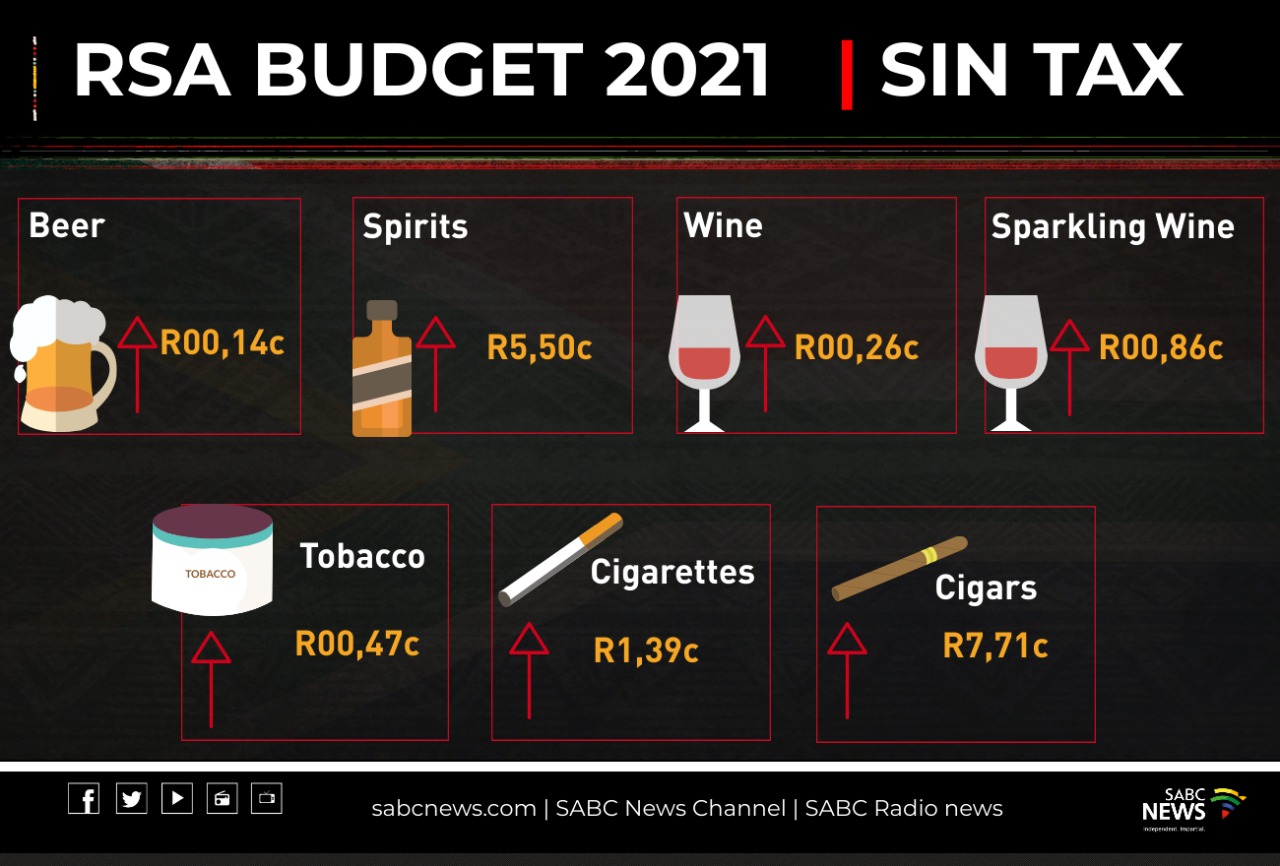

The Minister has announced an 8% increase in excise duties on alcohol and tobacco products, emphasising that excessive alcohol consumption can lead to negative social and health outcomes.

“From today: a 340ml can of beer or a cider will cost an extra 14c. A 750ml bottle of wine will cost an extra 26c; a 750ml bottle of sparkling wine an extra 86cl, a bottle of 750 ml spirits, including whisky, gin or vodka, will increase by R5.50, a packet of 20 cigarettes will be an extra R1.39c”