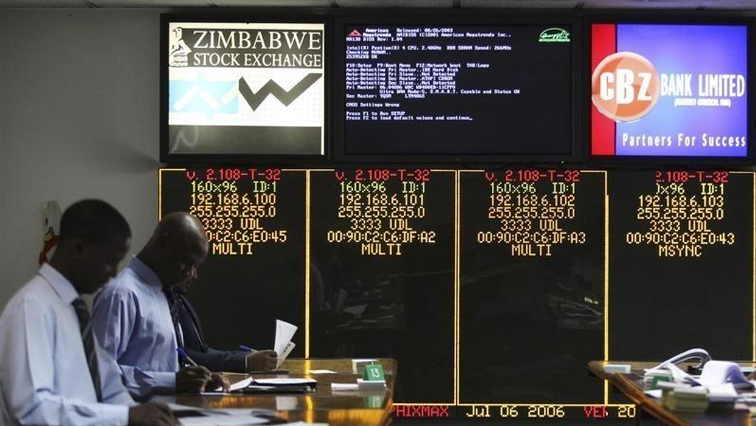

The Zimbabwe Stock Exchange is expected to lose further ground as investors speculate on chances that bank balances, which have been losing value against real US dollars for the better part of the year, could strengthen.

The bourse fell for the second consecutive day on Friday down 33% since the military took-over in the country.

The majority of Zimbabweans invest in the local stocks in an effort to hedge against the country’s economic meltdown and as a result the stock market surged 300% in US Dollar terms in recent months.

For much of this year Zimbabweans have been piling into stocks in an effort to counter falling bank balances against real US dollar notes.

A market commentator Maudi Lentsoane elaborates, “This primarily because when the stock market is detached from the economy, when it is performing poor then dominantly the local investors go to the stock market in the difficult times they hedge against rising cost.”

In October and November more than US$200m was invested on the Zimbabwe stock market, more than the $193m that was invested during the whole of 2016.

Real US dollars are currently trading at around 80% premium to bank balances.

Recent developments have prompted market speculators to take positions, causing the ZSE main Industrials index to shed 11.32% to close 432,72 points down on Friday.

Last week the industrial index saw a decline owing to political uncertainty.

Market analyst Lentsoane expects downward pressure to continue until there is a clearer picture on where the country’s economy will be heading when and if the current economic impasse is settled:

“That means the evaluations which were unrealistic needs to correct, they were way too high. It’s a return to normality.”

Some of the counters that tumbled include heavyweights Delta, Econet, and Old Mutual.