Two of the world’s most powerful finance officials are visiting Zambia this week, a reflection of the growing concern shared by Western officials about how China and other creditors are handling the African country’s debt. Zambia requested debt relief under the Group of 20 Common Framework nearly two years, but progress has been glacial at best, despite increasingly urgent appeals to China and private sector creditors to reach a deal.

Frustrated by the delays, U.S. Treasury Secretary Janet Yellen and International Monetary Fund Managing Director Kristalina Georgieva arrived for separate visits in Zambia on Sunday. Both see a new sovereign debt round table introduced late last year as a way to make progress on long-stalled debt restructuring processes.

While the overlap was coincidental, the two will meet informally while in Lusaka, a Treasury official said.

The specific date and guest list are still being worked out. Georgieva, who helped initiate the round table along with World Bank President David Malpass, told reporters this month it aimed to resolve broader issues such as transparency, timing of treatments and how to set cutoff dates for loans, but was not intended to replace the existing Common Framework.

The round table is a good idea, but the expectations should be kept very modest,” Indermit Gill, World Bank chief economist said.

Former senior Treasury official Mark Sobel said the round table could bring parties together for talks but it remained unclear if it would deliver results.

“The leaders of the round table need to have a focused agenda with clear goals and timelines, build a collective spirit and then keep the pressure on all parties to deliver results,” Mark said

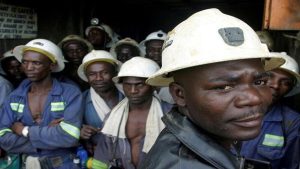

The delay in debt treatment is taking its toll on Zambia, according to the World Bank’s Gill: per capita income has slipped from middle-income to low-income status and about 60% of people now live in extreme poverty.

Gill sees parallels with the late 1970s, when the Federal Reserve raised rates to curb inflation, sending the U.S. economy into the worst recession since the Great Depression during the early 1980s. High U.S. interest rates ushered in what was labelled the ‘Lost Decade’ in Latin America, landing many countries in default.