As the Tax Season commences, the South African Revenue Service (SARS) has again outlined the requirements for those who should submit their tax returns.

This after the tax return threshold was increased from R350 000 to R500 000 meaning those who earn less than half a million rand a year will not be required to submit tax returns.

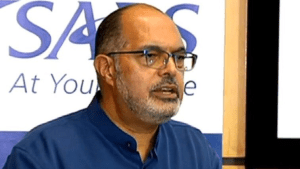

SARS Commissioner Edward Kieswetter briefs media on opening of tax season and related initiatives that will affect individual taxpayers #SARSfiling19 pic.twitter.com/5yVWfDVLoc

— South African Government (@GovernmentZA) July 1, 2019

SARS Commissioner Edward Kieswetter, on Monday announced the start of the Tax Season – saying eFilers and Mobile App users can start submitting their returns from Tuesday until the 4th of December.

Media Release: Tax Season opens for eFilers and users of SARS MobiApp #SARSTaxTips19 https://t.co/fyY88FA7Ef

— SA Revenue Service (@sarstax) July 1, 2019

Those who prefer to file their returns manually can do so from August.

Kieswetter says an SMS or email will be sent to those who don’t need to submit their returns.

“If you have the following criteria you don’t have to submit a return: if you earn below R500 000 a year from a single employer. In other words, you don’t have multiple streams of income, you have no additional expenses that you need to claim, like medical or otherwise.

“For those category of taxpayers below R500 000, we then say you don’t have to submit a return. We will send you an SMS or an email. So it couldn’t be any simpler for that category of taxpayers. For those who are still relatively straight forward in standard salary structure, but above R500 000, we invite them to either e-file or to use the Mobile App,” explains Kieswetter.