South African retailer TFG Limited priced its 3.95 billion rand ($237 million) rights issue at a 40.6% discount on Thursday as it pressed ahead with plans to reduce debt to cope with the coronavirus crisis.

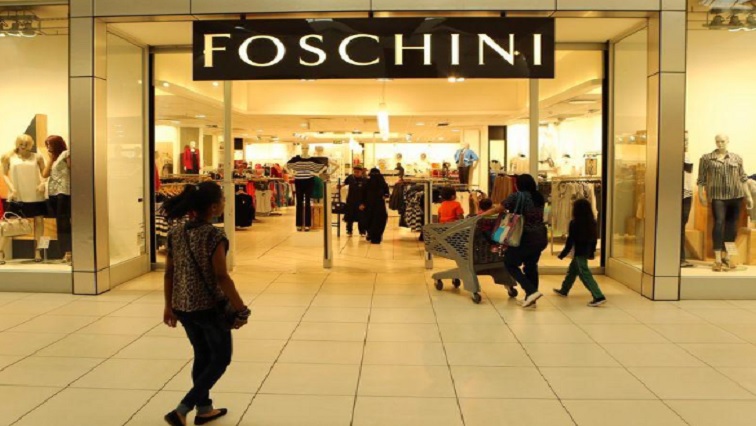

The owner of the Foschini and @home chains said in a statement it would offer 40 new shares for every 100 ordinary shares held at an issue price of 41.90 rand.

The discount is to the 30-day volume-weighted average price of TFG shares as at 15 July. The offer price represents a discount of 32.8% to the theoretical ex-rights price, or the projected price after the rights issue, the firm added.

The retailer will issue 94 million shares in total, constituting about 28.6% of TFG’s post-rights offer share capital.

At 1103 GMT, TFG shares were down 5.27% at 69 rand.

TFG, like fellow retailers, have been hit by the COVID-19 pandemic that resulted in store closures in all its markets in South Africa, the United Kingdom and Australia. All stores have since re-opened as governments ease restrictions.

But the retailer, which owns Phase Eight and Hobbs in Britain and menswear chain Retail Apparel Group (RAG) in Australia, expects a sustained period of economic uncertainty.