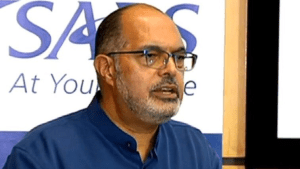

South African Revenue Service (Sars) Commissioner Edward Kieswetter says when he joined; he found an organisation with a broken spirit and low morale. The commissioner, who was appointed on 1 May, says he is working very hard to restore morale and is also addressing the issue of the loss of skills.

Kieswetter says they are reviewing all disciplinary cases starting from 2014 and where cases were created to support corrupt intent, these will also be addressed.

“When a policy is wrong it’s easy to fix it, when the hardware is spoiled it’s easily to fix it. What is hardest to fix is the spirits of people and sadly I have found that our staff have lost trust in the leadership and many of them have a broken spirit. We have unfortunately created a culture of fear and intimidation and racial tension is high in the organisation and the first step to change something is not to be in denial about it.”

Sars has announced that taxpayers who are registered for e-Filing or make use of the new Sars MobiApp can file their income tax returns from 1 July, while those who head to Sars branches can start filing their returns from the 1 August.

The closing dates for the tax season are the 31 October for branch filing, 4 December for non-provisional taxpayers using e-Filing and the MobiApp – and the 31 January 2020 for provisional taxpayers using e-Filing.

Speaking during a media briefing in Pretoria, Kieswetter says the tax return threshold has been lifted from R350 000 to R500 000.

“We have decided to increase the threshold from R350 000 to annual earnings of R500 000 and we will send an SMS for this group who are not required to send a return and we ask callers to heed this call as it is intended to simplify matters, imagine not having not to file a return and to be allowed to do so lawfully unless you fall into this category and you do have additional information that you want to declare.”

#SARS Commissioner Edward Kieswetter announces that taxpayers earning below R500 000 are now no longer required to submit returns. This is an increase from the previous threshold of R350 000. #TaxSeason2019 pic.twitter.com/mPxva5uKeb

— South African Government (@GovernmentZA) June 4, 2019