The Reserve Bank says the impact of the coronavirus is already starting to affect supply chains, global logistics and tourism.

The Central Bank says the financial market reactions reflect the uncertainty the world is facing. It says that based on this assessment it would take appropriate steps in accordance with its constitutional mandate to mitigate the risks to the South African economy.

The bank’s monetary policy committee is scheduled to announce its rate decision next week Thursday.

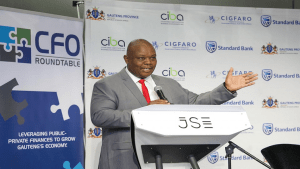

On this video below, Deputy Minister of Finance states that coronavirus will affect economic growth around the world:

There’s been major uncertainty on global markets, including the United States. United States President Donald Trump said the US economy might take a hit from the coronavirus outbreak but he predicted the challenge would eventually pass and defended his handling of the crisis.

The spreading coronavirus has led to a steep downturn in the stock market.

Trump said he would ask Congress for a payroll tax cut and other “very major” stimulus moves to ease the economic pain, but details were unclear.

Japan unveiled a second package of measures worth about $4 billion in spending, focusing on support to small and mid-sized firms.

Wall Street jumped more than 3% at the open but pared gains to about 1% in choppy trade. Investors hoped the sell-off on Monday marked the low of a downturn that has pushed the major US indexes close to bear market territory, a decline of 20% from recent peaks.

“Investors are trying put a bottom in here,” said Rick Meckler, partner at Cherry Lane Investments in New Vernon, New Jersey.

“It seems like that yesterday was such a collection of so much bad news, it shocked the market down. Today with fresh eyes people are picking out the names they think have dropped the most,” he said.

On this video below, President Donald Trump vows ‘major’ steps to aid US economy amid coronavirus rise:

Many strategists and economists expect the Federal Reserve to cut U.S. interest rates to zero as part of a global move to provide strength and liquidity to the financial system.

The dollar rallied after huge losses against the safe-haven Japanese yen and Swiss franc, but analysts said it was too early to predict a floor. The greenback plunged on Monday after the Saudi-Russia price war triggered the biggest daily rout in oil prices since the 1991 Gulf War.

Stocks in Asia rebounded, with Japan’s Nikkei closing up 0.85% after earlier touching its lowest level since April 2017.

China’s benchmark Shanghai Composite Index traded 2.1% higher as new domestic coronavirus cases tumbled and President Xi Jinping’s visit to the epicenter of the epidemic lifted sentiment.

The oil rally had the most horsepower. About half of its massive losses from Monday were clawed back, offering hope that markets had found a floor despite still-fragile sentiment.

Russian oil minister Alexander Novak said he did not rule out joint measures with the Organization of the Petroleum Exporting Countries to stabilize the market.

Benchmark Brent crude futures bounced by $2.83 to $37.19 a barrel, roughly half the level it started the year.

Gold prices fell 1%, retreating from the last session’s jump above the key $1700 level, as safe-haven demand waned a little amid speculation about global stimulus measures.

Analysts assumed policymakers would have to respond aggressively to prevent an economic crisis. The Fed on Monday sharply stepped up the size of its fund injections into markets to head off stress.

Having delivered an emergency rate cut only last week, investors are fully pricing an easing of at least 75 basis points at the next Fed meeting on March 18, while a cut to near zero was now seen as likely by April.

Britain’s finance minister is due to deliver his annual budget on Wednesday and there is talk of coordinated stimulus with the Bank of England.

The European Central Bank meets on Thursday and will be under intense pressure to act, even though euro zone rates are already deeply negative.

The bond market had charged ahead of the central banks to essentially price in a global recession of unknown length.

Yields on 10-year US Treasuries dipped to as little as 0.318% on Monday – a level unthinkable just a week ago – but rose back to 0.6787% on Tuesday amid the stimulus chatter. -Additional reporting by Reuters