The South Africa Reserve Bank says the poor state of government finances points to more job losses in the public sector. Reserve Bank has taken a unanimous decision to keep rates on hold at 6.75 as expected.

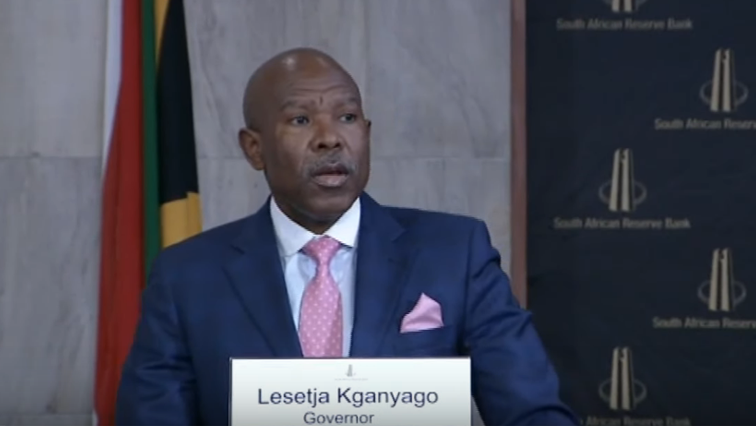

Delivering the monetary policy committee’s statement governor, Lesetja Kganyago, warned that the risks to the inflation outlook are on the upside due to a possible credit downgrade as a result of the deteriorating fiscal position.

The Reserve bank has flagged the deteriorating fiscal position in the country among factors that drive up inflation.

Kganyago says rating agencies may downgrade the country rating due to the poor state of government finances.

And what concerns the monetary policy committee the most is the impact of a downgrade on the local currency. According to Kganyago, it remains to be seen to what extent the rand would be hit by such developments.

“Downgrade of domestic currency debt could lead to SA bonds falling out of key indices which require invest grade. Such as invent could trigger sales of local bonds by non-residents. Rating review is expected but the extents to which the downgrade may be priced in remain uncertain. Lead up to the ANC conference and its uncertain outcome will weigh on the currency. Another event putting fear in the hearts of the MPC members is the uncertainties around ANC elective conference.”

Kganyago says the rand could get its second cue from the outcomes of the ruling party’s conference in December. These along with rising international oil prices may fuel inflationary pressures.

According to Kganyago these factors may prompt the bank to hike rates. “The MTBP revealed a rapidly deteriorating fiscal position. It was mainly due to lower taxes.”

Another threat to the favourable inflation outlook is the Eskom electricity tariff application.

Eskom has made a request to Nersa to hike electricity by 20%.

The banks warned that it may deviate from its current accommodative monetary stance depending on the data. This despite CPI now forecast at 5.2%.

The bank says its decision to formally announce a determined path of the repo rate does not imply an unconditional commitment to this policy path.

“The forecast and implied path are a broad guide to policy and not prescriptive. Depending on economic conditions the MPC may choose to diverge from the suggested path and alternative path may be generated.”

Kganyago says growth is likely to remain subdued coupled with lower business and consumer confidence.

S&P Global Ratings and Moody’s are set to review their ratings this week, with a one-notch cut of the local-currency rating by both agencies likely to trigger forced selling of the country’s bonds.

Click below to watch video: