As the country waits for the Reserve Bank to announce the next interest rate hike Thursday afternoon, middle-class South Africans may feel an extra pinch on their already-thin wallets.

Currently, the repurchase rate sits at 7.75% while the prime lending rate is at 11.25%. The Reserve Bank has increased rates by 425 basis points since November 2021. This would be the tenth interest hike since November 2021.

Economists say the central bank will likely hike by anything between 25 and 50 basis points. This comes as the Bank tries to bring down inflation which has been above its target bracket for exactly a year this month.

Consumers continue to battle the high cost of living, and it does not look like things are about to get any better. Food and fuel inflation remain upside risks and it’s expected that load shedding will also add salt to the wound.

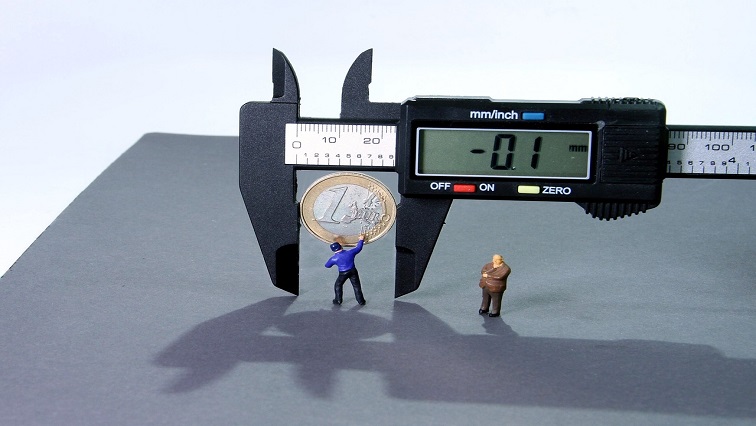

For homeowners, this is what their repayment could look like with a half-a percent hike.