South African homeowners are feeling the pinch after the South African Reserve Bank’s (SARB) Monetary Policy Committee (MPC) hiked the repo rate by 75 basis points to 5.5 percent last week.

The hike means homeowners are now expected to adjust to the higher bond costs.

KwaZulu-Natal’s Head of Commercial Property Finance at FNB Malusi Mthuli says more people are unable to qualify for home loan finance because they do not have enough disposable income.

Mthuli is advising home owners to consult their banks to restructure their payments.

“With the increase in debt repayments, obviously it erodes affordability in a sense of a disposable income. As a result of the reduction in affordability. You need to consult your bank. You will be able to get advice on how you can restructure your debt, its called a debt restructure,” Mthuli says.

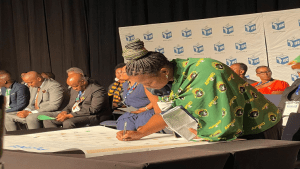

Reaction to MPC decision to hike repo rate: