The Reserve Bank’s Monetary Policy Review has shown that persistent supply constraints and robust growth in demand, at a global level, are expected to drive up inflation in South Africa.

The Bank says that while inflation risks remain high in the domestic economy for 2022, economic growth is expected to be stronger than previously forecast, due to stronger commodity export prices.

The Reserve Bank made these assertions during a virtual media briefing to present its Monetary Policy Review on Tuesday.

As geopolitical tensions in Eastern Europe remain elevated, the Reserve Bank anticipates that higher input prices and disruptions to global trade have increased downside risks to global growth and inflation.

The Bank expects global growth to decelerate sharply to 3.7% in 2022, down from an estimated 6.4% last year.

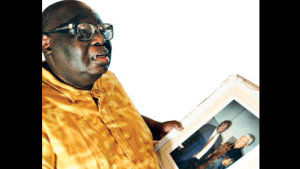

Reserve Bank Governor Lesetja Kganyago said, “Progress towards more stable economic conditions remains under threat. Price pressures have intensified as demand has recovered quickly while supply chains have been slower to recover. The war in Ukraine has exacerbated global price inflation, while dragging down global growth. Price pressures are also evident in South Africa.”

The Reserve Bank expects economic growth in the first quarter of the year to reach 0.8%, while growth for the full year has been revised up to 2%.

Reaction to Reserve Bank repo rate increase decision:

Slow rate of recovery

Lead Economist at the Reserve Bank, Witness Sambanegavi says although economic growth is expected to continue, the slow rate of recovery had an adverse impact on jobs.

“Three sectors have actually recovered to beyond their 2019 output, and these are agriculture finance, community and social services. But we also see that some sectors, especially construction and transport and trade, remain far below their 2019 output. The difference of recovery is of concern, particularly given that some of these sectors are very labour intensive. So their slow recovery is impeding economic wide recovery and jobs,” says Sambanegavi.

Fuel prices

The Bank expects the headline consumer price inflation to average 5.8% in 2022, underpinned by rising fuel prices and elevated food inflation.

“Fuel price inflation has aggressively increased. If you look at November, to January and then to March and substantially higher now. But it is expected to come down substantially in 2023, partly due to base effects, and partly because we do expected oil prices to moderate substantially in 2023,” says Sambanegavi.

The Reserve bank says higher commodity prices have boosted the current account surplus and provided cheap financing for government spending.