Finance Minister Malusi Gigaba has question measure used by some rating agencies to determine South Africa credit rating. This is in the wake of last week’s ratings outcomes by two agencies.

On Thursday, Fitch Ratings agency downgraded South Africa’s long-term debt to junk status and Standard & Poor’s followed suit on Friday, while Moody’s placed the country on review for a downgrade.

Political uncertainties ahead of the ANC’s National Elective Congress have been cited as one of the key challenges facing the country.

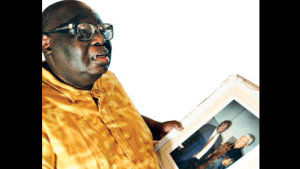

Gigaba had to embark on the roadshow to quell the investors’ concerns.

Infighting within the ruling African National Congress ahead of an elective conference in December has impacted negatively on investor confidence in Africa’s most industrialized economy. There has been no movement on the economic growth in recent years.

Gigaba has, however, slammed reports that the conference is likely to adopt new policies and even going as far as saying the conference not likely to take place.

“What prompted S&P to move is what they regard as political risks associated with political risks of the upcoming ANC conference, which took us by surprise because the ANC has national conferences every 5 years. It cannot be that every five years we are going to be downgraded because of uncertainties around the ANC conferences. The ANC is a democratic organization and hence every five years it goes to conferences. No one is guaranteed a position as if the ANC turns into a dictatorship where leadership is not contested and policies of the ANC are not open for review by members of the ANC at conferences.”

Meanwhile, government has been given a clear warning by ratings agencies and economists that there needs to be fiscal prudence.

However, Gigaba insist that the country is on track.

“I think rating agencies need to review the way they treat the five-yearly conferences of the ANC so that they don’t find themselves adopting reviews that are going to be subject to criticism, as being biased, as being subjective and being unfair on the country. Because in large measure, when you look at the structural reform issues, the fiscal consolidation issues we are implementing; our efforts to stabilize the debt, we are virtually faultless. We have stayed the line to ensure that we manage our fiscals in a manner that is credible and commendable. ”

However, economist Lumkile Monde says concerns by rating agencies are warranted.

“South Africans are talking about boycotting taxes, where South Africans are saying ‘in this government, we don’t get value for money’; the mass demonstrations in various localities, whether it’s Soweto were people are demanding electricity, or house … it’s a crisis that 23 years later a government that was so popular is facing credibility issues amongst its own constituencies. Therefore, the investors are reacting to what the South African public is responding to – failure to curb down corruption and arrest those responsible and the failure to signal that black South Africans under their government, they have been treated differently than they were under a white government.”

In the wake of negative rating, President Jacob Zuma has directed Minister Gigaba to identify concrete measures to urgently address challenges identified in the Medium-Term Budget Policy Statement.

The president, together with Cabinet, have reaffirmed government’s commitment to maintain a sustainable fiscal framework.

Zuma wants a committee to show him progress this week on plans to cut government spending by R25 billion and raise taxes by up to R15 billion.

Monde welcomed the president’s latest move with caution.

“(He has) firstly not done anything about the expose around how the minister of mines went on a plane with the Guptas to take away resources which was pre-funded by Eskom. So, lack of that responsibility, where the constitution expects him to do that – that has not happened – indicates to us that whatever the president says take it with a lot of salt because up until he leads, he ensures that there is accountability – that our security agents do what they are constitutionally supposed to do, we remain very skeptical, if anything, will come out of the budget in 2018.”

If Moody’s in the next few months decides to downgrade South Africa to junk status, the impact on the fiscus will be severe. This will make it even more difficult for the minister to strike a balance in appeasing the electorates over campaigns such as fees must fall ahead of the 2019 elections as well as retaining investor confidence.