This week’s episode of Special Assignment takes a further look into the R699 scandal, following a barrage of calls from many disgruntled customers, who provided further details about their bad experiences with car dealer and agent – Satinsky 128.

We focus our attention on the role that Nedbank’s MFC, ABSA Bank and Standard Bank played in this saga as people received car loans despite the fact that their credit profiles disqualified them from being granted such loans. Did the banks know this or were credit profiles manipulated to ensure that they qualify? If so, who was responsible for that?

Questions are now also being asked about whether the cars bought through Satinsky are even new as advertised. We speak to a customer who shows us proof that the new car he purchased in March this year, is in fact a used vehicle.

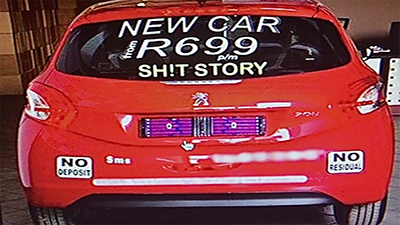

In Satinsky’s now crumbled R699 business model, customers drove cars around advertising for the low car deal for the company, thus attracting new customers. Customers, who bought a car through Satinsky and advertised for the company, got paid certain amounts which could go towards servicing those monthly car instalments. Satinsky acted as agents to negotiate deals with the banks, to get car loans for their customers. Satinsky failed to pay these promised monies and people are now sitting with car debts that they could not afford in the first place.

This month, the company and its subsidiaries: Just Group Africa, Drive Car Sales and Agera Cars, announced that they would stop running the deal effective immediately and that customers would no longer be paid advertising rebates. The collapse of the deal has left an estimated 29 000 customers out in the financial cold.

Duncan Heuer – The Lawyer who is trying to get the PE High Court to allow R699 customers to start a class action.

– By