Being a minimum wage earner often means that after feeding one’s family and deducting travel money, there isn’t much left for other needs. Let alone saving for ones’ future…

Every day – every cent is accounted for.

During apartheid, there was no access to skills development, which would have meant a better earning opportunity. This resulted in people often staying in mundane, low-paying jobs without a vision to grow. This continued over generations and it’s resulted in an ongoing debate about financial inclusivity and exclusivity.

The initial concept of financial inclusion referred to the delivery of financial services to low income sectors of society at an affordable cost. The concept seems to be broadened to include the use and access to a full suite of quality financial services, at affordable prices, in a convenient manner.

The World Bank estimates there are approximately two billion adults excluded from the financial sector worldwide.

South Africa is doing well on that front.

At least 90% of South Africans have access to financial products, whether through a bank account or insurance and funeral policies.

Electronic grant payments and the usage of pre-paid cards are cited as some factors that have led to the financial inclusion gains.

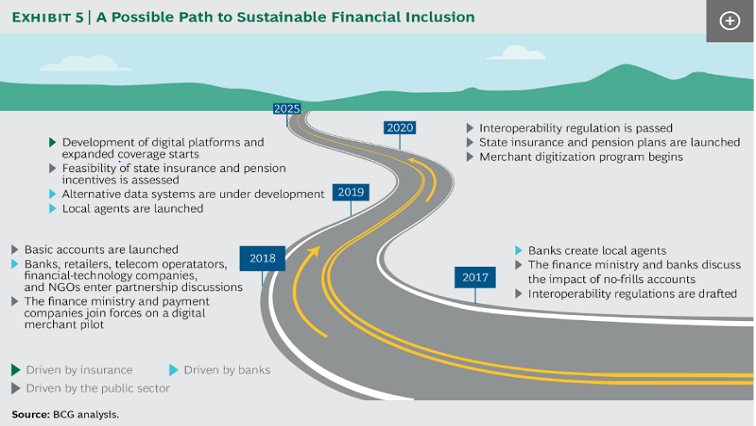

Despite this, however, global management company, the Boston Consulting Group, believes policy-makers need to come up with ways to ensure sustainable financial inclusion in the country.

“Many South Africans devote a large and unsustainable share of their disposable income to these life, funeral, and burial polices. In interviews, we discovered that many of these policies would make economic sense only if there were a death in the household every 2.5 years. Other policies were better deals, but rarely were consumers better off having funeral and burial coverage instead of saving their money,” reads the company’s 2017 report on the matter.

The firm says the tools used, currently, to measure inclusion are either too simple or too academic.

“Family prosperity, GDP growth, and reduction of poverty rates are closely linked to financial inclusion, which should feature prominently in building a more promising future for South Africa.”

Watch insert below on other factors perpetuating financial exclusion in SA: