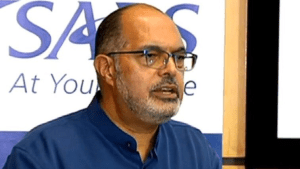

The South African Revenue Services (SARS) Commissioner, Edward Kieswetter, has announced that the tax return threshold has been lifted from R350 000 to R500 000.

Speaking during a media briefing in Pretoria, Kieswetter says those who earn less do not need to file.

Kieswetter says taxpayers who are registered for e-Filing or make use of the new SARS MobiApp can file their income tax returns from July the 1st, while those who head to SARS branches can start filing their returns from the 1st of August.

“We’ve decided to increase the threshold from R350 000 to an annual earnings of R500 000 and this means you are not required to submit a return if the following is true: Your total income for the year is not more than R500 000. You only receive income from a single employer. You have no other form of income such as a car allowance, business income, taxable interest, rental income or income from another job. You have no additional deductible allowances such as medical expenses, travel expenses or retirement annuities. We will send an SMS to this group of taxpayers who are not required to file,” says Kieswetter.

Kieswetter has outlined improvements and changes made ahead of the 2019 tax season. He says SARS has implemented technological innovations to make submissions easier.

The revenue collector is aiming for people to use their e-filing service, rather than heading to SARS branches.

Kieswetter says free WiFi will be provided in SARS branches and to those using mobile units to file online.

“To reach out to many of our communities where there may not be an office nearby, we have 23 mobile tax units deployed that will assist taxpayers in remote areas and also assist them to convert them to e-filing and to the mobi-app. We have decided to provide free WiFi at these mobile tax units and also within our branches so that taxpayers who may not have connection to WiFi are able to come to our branches and in a facilitated way we can convert them to become online filers,” says Kieswetter.

Kieswetter says the organisation is working hard to earn the trust and confidence of the South African public. The commissioner says that where tax morality has declined, it’s working hard to improve it.

The 2019 tax season begins on the 1st of August for taxpayers who file their tax returns at SARS branches. Taxpayers who are already registered for e-Filing or have access to the MobiApp, can file their tax returns online from the 1st of July.

Kieswetter says the revenue service has seen more tax payers filing through branches, rather than using the app and online filling.

Watch a related video below: