The Reserve Bank’s Monetary Policy Committee has decided to keep the repo rate unchanged at 3.5%.

The decision means the prime lending rate remains at 7%.

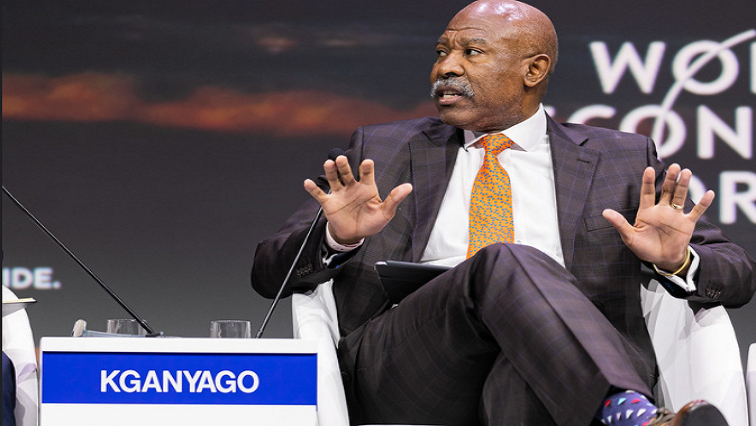

The decision was announced by Reserve Bank Governor, Lesetja Kganyago, this afternoon.

Kganyago says the bank expects inflation to remain well contained for the rest of the year before edging up to the midpoint of the target range next year.

“Local food inflation is slightly lower than previous expected and should remain broadly continue to higher local crop production, oil prices have increased sharply this year and are expected to remain at this level over the forecast horizon, electricity and other administered price remain upside risk to the inflation trajectory against this background MPC decided to keep rates unchanged at 3.5 percent. The decision was unanimous,” he says.

The Reserve Bank Governor has warned that the new wave of COVID-19 infections is likely to weigh on economic activity both globally and locally.

He says the distribution of vaccines will be slow, contributing to uneven pace of global economic recovery this year and next.

Despite the risk of COVID-19, the bank expects the economy to grow by about 3.8% this year.

Reaction to the announcement:

In reaction to this, economist at BNP Paribas, Jeff Schultz, says: “It’s warning of a third wave of infection also toning down its CPI number even beyond 2021.

On balance while its quarterly projections model suggests that we could see rate hike this year it will be data dependent I don’t think the Central Bank is in a big rush to raise rates in what is still a fragile economic recovery.”

Consumers have been advised to take advantage of the current low interest rate environment and pay-up their debt.