The South African Reserve Bank does not expect the economy to shrink in the second quarter, as it did in the first, Governor Lesetja Kganyago said on Friday, while warning that growth remained too low to make a dent in high unemployment.

South Africa’s economy grew by 3.1% in the final quarter of 2017 but contracted 2.2 % in the first quarter of this year, led by a slowdown in agriculture and mining.

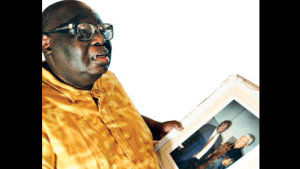

“At this stage, the high-frequency data for the second quarter indicate that a modest improvement is likely in the quarter, and the South African Reserve Bank does not expect a second consecutive quarter of contraction,” Kganyago said at the bank’s annual general meeting.

The first-quarter gross domestic output contraction highlighted the huge challenge President Cyril Ramaphosa faces if he is to deliver long term economic growth.

The economy has barely grown in the past decade with fiscal missteps and corruption contributing to weak business and consumer confidence.

Last week, the bank held benchmark interest rates and cut its growth forecast for 2018 to 1.2% from 1.7 %.

It said economic activity would be constrained in the near term by weak consumer spending linked to the recent increase to value-added tax and by unemployment, which is near record levels.

“At these growth levels, we cannot expect to make appreciable inroads into the unemployment problem of the country,” Kganyago said.

Friday’s AGM was the first since the ruling African National Congress (ANC) agreed in December to move to full state ownership of the SARB. Kganyago repeated that any change of ownership would not affect the bank’s mandate or independence.

Unlike most central banks in the world, the South African Reserve Bank has been privately owned since it was established in 1921. But its shareholders have no control over monetary policy, financial stability policy or banking regulation.

“Indeed, it is the case that a group of shareholders is agitating for the SARB’s nationalisation as they believe that they are entitled to a share of the assets of the SARB and see this as an opportunity to make enormous profits at the expense of taxpayers,” Kganyago told the AGM.

“This could turn out to be a protracted legal process and a very expensive exercise for what would, at best, be a cosmetic gain. To reiterate: whatever the shareholding structure, the primary mandate of the SARB will remain unchanged.”