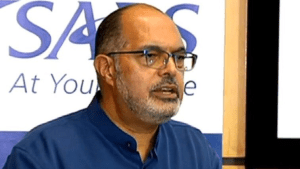

SA Revenue Service (Sars) commissioner Edward Kieswetter says the organisation is working hard to earn the trust and confidence of the South African public. The commissioner says that where tax morality has declined, it’s working hard to improve it.

The 2019 tax season begins on 1 August for taxpayers who file their tax returns at SARS branches. Taxpayers who are already registered for e-Filing, or have access to the MobiApp, can file their tax returns online from 1 July.

While #TaxSeason2019 will start on 1 August for all taxpayers, digital platforms will be available for efiling from 1 July. pic.twitter.com/ExOJFtyS4q

— SA Gov News (@SAgovnews) June 4, 2019

Speaking during a media briefing in Pretoria, Kieswetter says the revenue service has seen more tax payers filing through branches, rather than using the App and online filling.

South Africans earning a monthly income of R41 600 or less will not have to submit tax returns. SARS announced that tax return threshold increased to R500 000 from R350 000 per annum.

However, those exempt from filling tax returns will need to prove to SARS that they are receiving an income from one employer only, have no other income such as car allowances or rental and must have no additional deductibles such as medical expenses, travel or retirement annuities.

#SARS Commissioner Edward Kieswetter announces that taxpayers earning below R500 000 are now no longer required to submit returns. This is an increase from the previous threshold of R350 000. #TaxSeason2019 pic.twitter.com/mPxva5uKeb

— South African Government (@GovernmentZA) June 4, 2019

Kieswetter says this is part of Sars new initiative to make tax filing easier this season

“We have decided to increase the threshold from R350 000 to annual earnings of R500 000 and we will send an SMS for this group who are not required to send a return and we ask callers to heed this call as it is intended to simplify matters. Imagine not having to file a return and to be allowed to do so lawfully unless you fall into this category and you do have additional information that you want to declare.”

The commissioner says they have improved their online filing and filing at branches with several new innovations. The improvements will make it more convenient for taxpayers to file for income tax returns. It includes issuing of customised notices indicating specific documents required in the event of an audit.

Meanwhile, those using the Sars MobiApp will also be able to scan and upload their documents using the App. Kieswetter has urged more citizens to make use of the Sars e-Filing system

“If the public unnecessarily visit’s our branches, it creates a service impact for those that need to be there. We then realised that we have to work harder to achieve the outcomes and we did that this year by enhancing our service features to encourage more tax payers to use the convenience of online. So should you wish to convert to online filing and you require help, we do invite tax payers to come to our branches where we will register and submit your returns electronically. This is a mutual benefit and improves services to tax payers.”

Kieswetter encourages taxpayers to use digital platforms to submit their tax returns. He says @sarstax digital platforms are being enhanced to address concerns and usability #TaxSeason2019 pic.twitter.com/CP6wD9uYnl

— SA Gov News (@SAgovnews) June 4, 2019

Meanwhile, the commissioner says he has been hard at work and visiting all the branches and meeting with staff since he joined Sars in May. Kieswetter says, when he joined, he found an organisation with a broken spirit and low morale. Sars is also addressing other issues including tax refunds and the loss of skills.

Kieswetter says they are reviewing all disciplinary cases from 2014 to present and where cases were created to support corrupt intent, these will also be addressed. He also says they are working with the Special investigating Unit and the NPA to fast track all pending investigations, and those implicated will be charged from outcomes of on-going commissions

“When a policy is wrong, it’s easy to fix it; when the hardware is spoiled, it’s easily to fix it. What is hardest to fix is the spirits of people and. Sadly, I have found that many of our staff have lost trust in the leadership and many of them have a broken spirit. We have unfortunately created a culture of fear and intimidation and racial tension is high in the organisation. And the first step to change something is not to be in denial about it.”

WATCH VIDEO BELOW: