The CEO of Eskom, Phakamani Hadebe, warned that the power utility teetered on the edge of a debt trap. He warned that unless revenue earned by the massive state owned utility increased markedly it would not be able to cover the costs of the debts it had incurred.

To forestall the collapse of the power giant, Eskom seeks approval for a 15% increase in electricity prices in each if the next three years.

As Eskom produces 90% of the countries electricity. A large increase in the price of electricity or the collapse of the state entity will have an enormous economic impact.

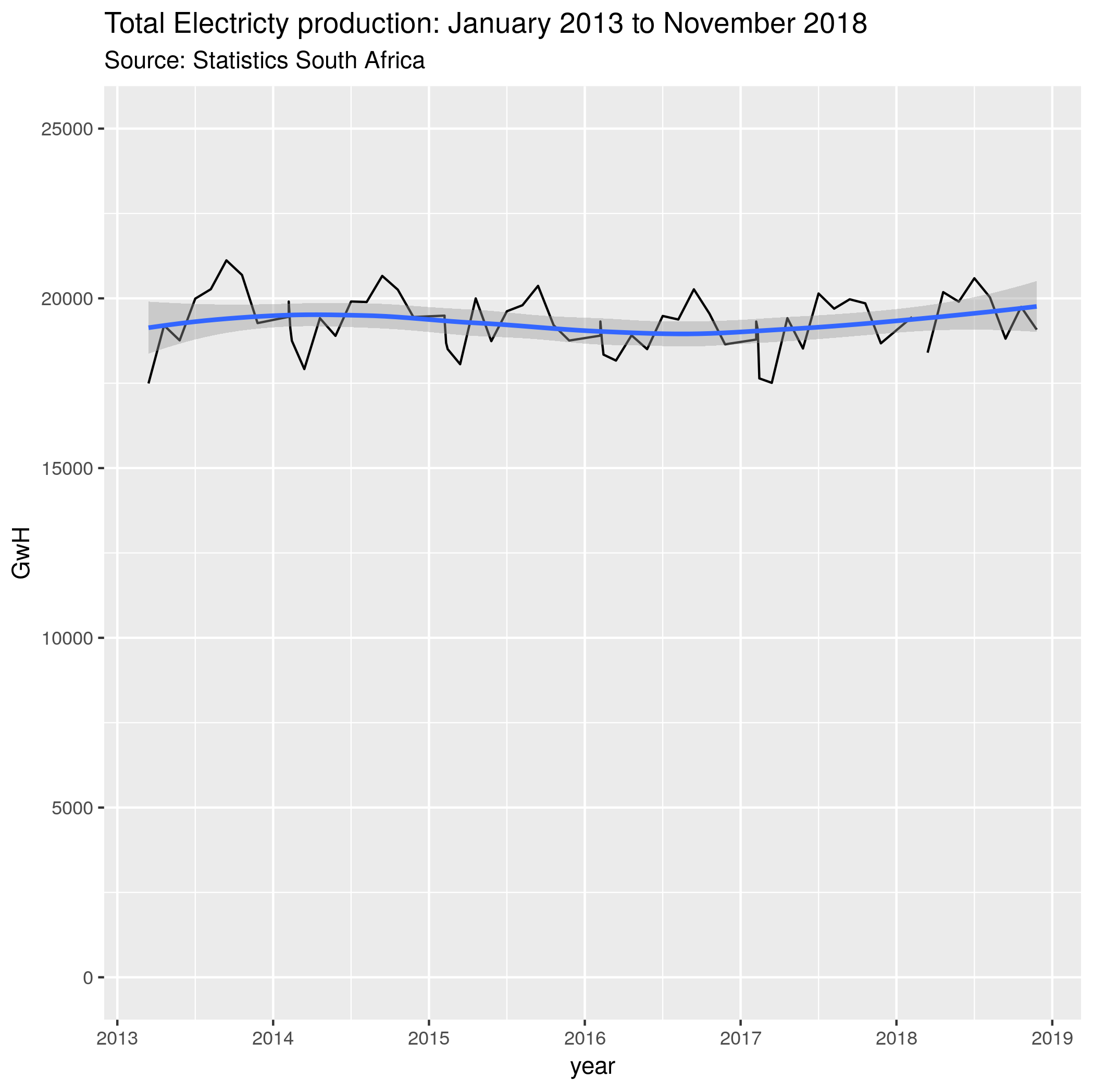

The situation faced by Eskom is aggravated by the utility, despite massive investment in the Medupe and Khusile generation projects, failing to generate more electricity. Figures released last month by Statistics South Africa show that electricity generation has remained flat since 2013. Power generation peaked in July 2013 when 21-million megawatt hours of power was generated (21 119 GwH) nationally.

In recent years, Eskom has managed to increase the price of electricity markedly. The tariff increases now proposed will result in a further almost 50% rise in prices over the three years. If the tariff increases reduce demand sufficiently Eskom will then face a ‘fiscal cliff’.

A fiscal cliff arises when tariff increases are needed but any price increase results in declining revenue because of reduced demand. If this happens the state entity cannot be sustained.